Platform Feature

Stay Listed. Stay Strong. Stay Ahead.

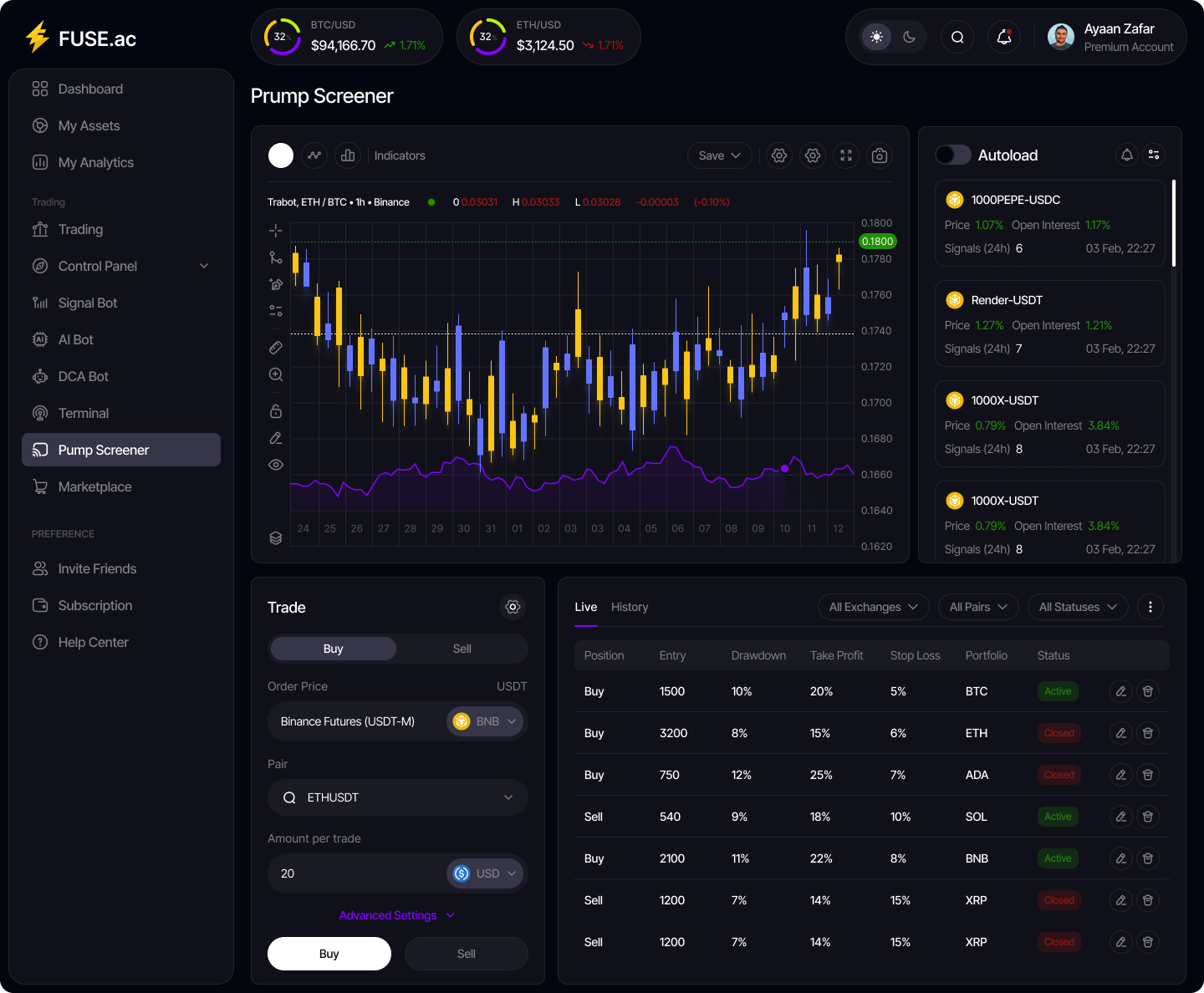

Protect your token’s listing with FUZE.ac’s automated KPI Engine—designed to detect, defend, and demonstrate compliance across every exchange rulebook.

The High Stakes of CEX Listings

Listing on a tier‑1 exchange unlocks liquidity—but one KPI miss can trigger delisting notices, erode credibility, and dry up volume:

- Minimum Volume: Failing 15‑day averages (e.g., US$30k/day) puts you on watch.

- Spread Limits: Spreads > 3% risk suspensions and trading halts.

- Price Retention: Drops > 20% from TGE invite removal.

- Depth & Wallet Count: Thin books and low user counts flag risk zones.

Operating Blind?

Operating blind means risking everything. FUZE.ac shines the light.

How FUZE.ac Automates Compliance

1. Exchange Rule Database

We maintain a live library of every key KPI for 40+ CEXs, including volume thresholds, spread limits, price retention rules, and depth requirements.

2. Real-Time KPI Engine

Our engine provides continuous monitoring, historical pass/fail logging, and early alerts when metrics approach warning levels.

3. Proactive Defense

On KPI drift, AI MM bots automatically switch to Volume Boost Mode, Spread Clamp Mode, or Depth Rebuild Mode to fortify order books.

4. AI-Driven Insights

Your embedded ChatGPT assistant can explain KPI breaches, recommend corrective actions, and generate investor-ready compliance summaries.

Business Impact & Benefits

| Benefit | Outcome |

|---|---|

| Prevent Delisting | Keep your token live and tradable on top exchanges |

| Build Confidence | Show investors your token meets institutional standards |

| Data-Driven Ops | Replace guesswork with automated, rule-based strategies |

| Transparent Audits | Opt-in public scorecards to boost community trust |

FUZE.ac turns compliance from a reactive chore into a proactive growth driver.

Ready to See FUZE.ac in Action?

Book a personalized demo and discover how our platform can optimize your liquidity, protect your token, and unlock sustainable value.