Platform Overview

Empowering Web3 with Stability, Efficiency, and Real Yield

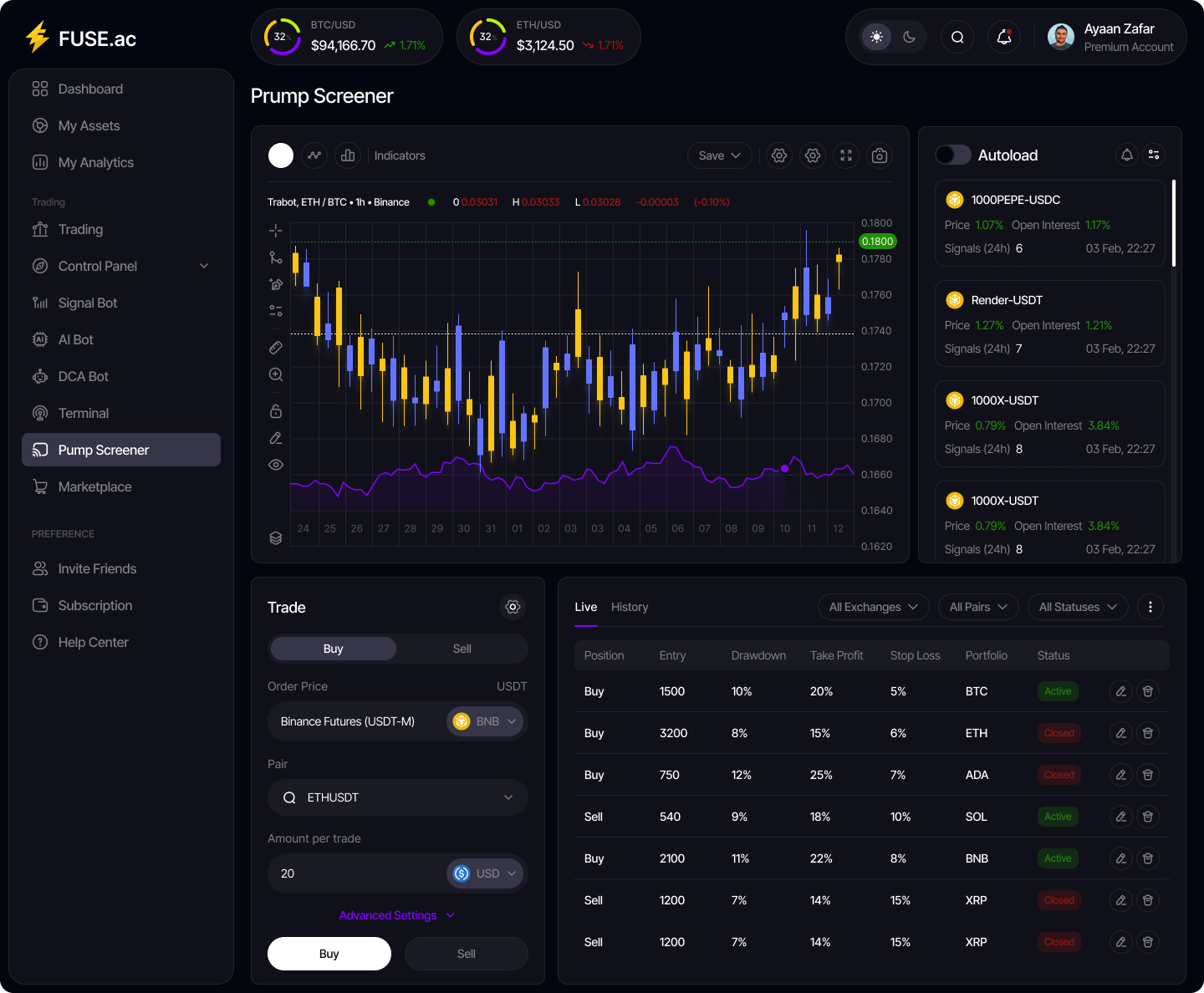

FUZE.ac: The Operating System for Your Token’s Economy

A unified platform designed to power the entire post‑launch lifecycle of tokenized ecosystems. From unlocking utility to enforcing compliance, our modular architecture replaces fragmented vendor stacks with a performance-driven OS for Web3 assets.

The Post‑Launch Growth Challenge

Launching is just the start. Today’s token teams face:

- Unmanaged Unlocks: Vesting cliffs trigger sell‑offs, erode trust.

- Shallow Liquidity: Thin order books amplify volatility.

- Compliance Risks: Evolving CEX rules can lead to sudden delisting.

Traditionally, projects patch together OTC desks, MM vendors, compliance consultancies, and analytics tools—resulting in slow, reactive, costly operations.

Command Center: FUZE.ac integrates every function you need after TGE, under one roof.

Core Platform Modules

1. AI Market‑Making Engine

Autonomous, RL‑powered bots maintain tight spreads and deep order‐book presence across 40+ venues.

- 15+ Strategies: Listing‑Day, Dump Recovery, BTC Sync, Volume Boost, Anti‑Manipulation, Weekend Chill, and more.

- Custom Profiles: Tailor spread targets, depth quotas, and mode‐switch triggers per token and stage.

- Real‑Time Dashboards: Live PnL, spread, and depth metrics with Merkle‑rooted proof of liquidity.

Available as a SaaS layer—no in‐house quant team required.

2. Token Release Management

Sync your vesting spreadsheet directly with our bots to turn unlock events into managed liquidity milestones.

- Cliff & Linear Vesting import

- Pre‑Unlock Defense: Pause aggressive sells, cushion volume shocks

- Post‑Unlock Absorption: Stagger buy ladders to soak sell pressure

- Dynamic Sell‑Wall options for large‑scale releases

Unifies TokenUnlocks analytics with execution.

3. KPI & Compliance Tracker

A live monitor for exchange‑specific performance standards—keeping you out of hot water.

- Exchange Rule Library for Binance, Gate, KuCoin, OKX, MEXC, and more

- Automated Strategy Switches: Volume‑Boost or Spread‑Clamp on KPI drift

- Alerts & Reporting: Imminent risks, monthly scorecards, public badges (opt‑in)

Combines token analytics dashboards with MM guardrails.

4. OTC Deal Engine

Raise capital without the post‑unlock panic.

- KPI‑Bonded Escrows via smart contracts or multisig

- Milestone‑Based Vesting: CEX listing, volume thresholds, product launches

- Unlock‑Aware Sync: Bots deploy defensive modes around investor releases

- Transparency: Public unlock calendar, “OTC‑Aware” dashboard badge

Professionalizes fundraising—creates a win‑win for projects, investors, and community.

5. Token Utility Amplifier (FUSE PlayHub)

Turn passive tokens into engaging game fuel.

- One‑Click GameVault spin‑up for any token.

- Mini‑Game Library: Dice, duels, tournaments with real token stakes

- Revenue Split: 80% winners • 17% project • 3% FUZE staker vault

- Cross‑Platform Delivery: Web, Telegram, iOS/Android web‑view

Boosts on‑chain volume by +28% and CEX liquidity by +35% in pilot tests.

Strategic Impact: Beyond Liquidity

FUZE.ac is more than a toolkit—it’s the backbone for scalable, sustainable token economies.

Enhanced Token Utility

Stable markets enable tokens to serve as governance, payments, and in-app currency.

Holder Confidence

Transparent, automated defenses build trust and reduce FUD.

Foundation for Expansion

Proven infrastructure attracts tier‑1 exchanges, institutional capital, and ecosystem partners.

Ready to See FUZE.ac in Action?

Book a personalized demo and discover how our platform can optimize your liquidity, protect your token, and unlock sustainable value.